- Income Statement Template Microsoft Word

- Income Statement Template Microsoft Word Template

- Income Statement Template Microsoft Word 2019

- Witness Statement Template Microsoft Word

An income statement or profit and loss statement is an essential financial statement where the key value reported is known as Net Income. The statement summarizes a company's revenues and business expenses to provide the big picture of the financial performance of a company over time. The income statement is typically used in combination with a balance sheet statement.

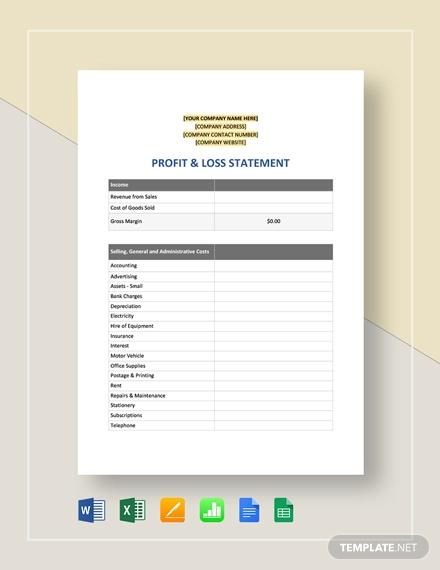

Instantly Download Income Sheet Templates, Samples & Examples in Adobe PDF, Microsoft Word (DOC), Microsoft Excel (XLS), Google Docs, Apple (MAC) Pages, Google Sheets (Spreadsheets), Apple (MAC) Numbers. Quickly Customize. Easily Editable & Printable. Sample Report Monthly Income Statement in Word. Monthly income statement information for current month and YTD along with graphs inserted into a Word document. Profit and Loss Statement. A profit and loss statement as the name implies depicts the profitability of the company as well as the losses which occur when the expenses are deducted from the generated revenues. The profit and loss statement is also called the income statement but it is different from a cash flow statement. This income statement template is completely free to download and we are sure you will like it a lot when making income statement for personal or professional purpose. Income statement can be recognized as a financial statement of the business organization or company that shows its revenues subtracting various costs and expenses over a mentioned period of time.

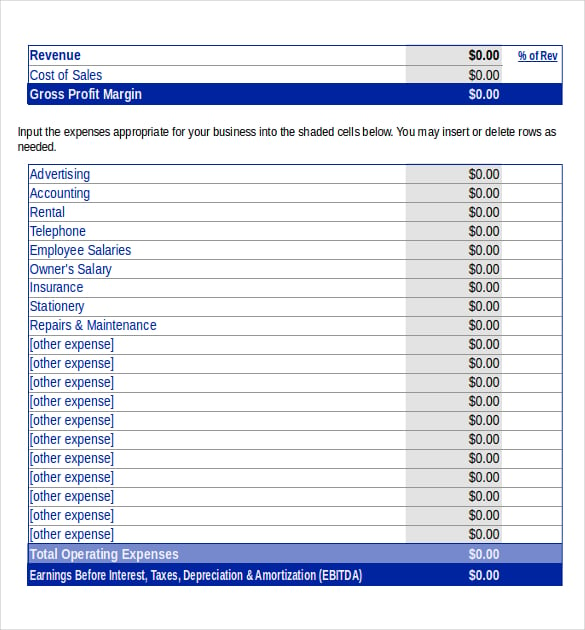

There are many ways to format an income statement. The two examples provided in the template are meant mainly for small service-oriented businesses or retail companies. (1) The simplified 'single-step' income statement groups all of the revenues and expenses, except the income tax expense. (2) The 'multi-step' income statement example breaks out the Gross Profit and Operating Income as separate lines. It first calculates the Gross Profit by subtracting Cost of Goods Sold from Net Sales. It calculates the Operating Income and then adjusts for interest expense and income tax to give the Income from Continuing Operations.

If all of those terms are making you queasy, read below the download block for more information.

Download

⤓ Excel (.xlsx)⤓ Google SheetsOther Versions

License: Private Use (not for distribution or resale)

Description

This income statement template was designed for the small-business owner and contains two example income statements, each on a separate worksheet tab (see the screenshots). The first is a simple single-step income statement with all revenues and expenses lumped together.

The second worksheet, shown on the right, is a multi-step income statement that calculates Gross Profit and Operating Income.

Income Statement Essentials

Net Income = Total Revenue - Total Expenses

Revenues

The income that is generated by providing a service, selling a product, earning interest on investments, renting extra office space, licensing technologies, selling advertising space, or licensing the use of your brand name. In the income statement template, there are categories for Sales revenue, Service revenue, Interest revenue, and Other revenue. You will likely want to customize the Revenue section to highlight your company's main sources of revenue.

Cost of Goods Sold (COGS)

For a retail company, one of the main expenses is the cost of goods sold. So, you'll see Cost of Goods Sold broken out into its own section, with Gross Profit calculated as the Net Sales minus Cost of Goods Sold. Use the MultiStep worksheet in this case.

The cost of goods sold can be calculated by adding beginning inventory, goods purchased, raw materials and direct labor for goods manufactured, and then subtracting the ending inventory.

For service businesses, COGS might not be such a large factor, so that is why the SingleStep worksheet doesn't have a separate COGS section.

Operating Expenses

This section is where you include all your operating expenses such as advertising, salaries, rent, utilities, insurance, legal fees, accounting fees, supplies, research and development costs, maintenance, etc. Don't include interest expense and income taxes (they will be included later).

Operating Income (EBIT)

In the multi-step income statement, the operating income is calculated as the Gross Profit minus the total Operating Expenses. In general, interest expense and income tax expense are not included as operating expenses, which gives rise to the term EBIT or 'earnings before interest and taxes' - another name for Operating Income.

Income from Continuing Operations

This is the 'bottom line', calculated as the Operating Income minus interest expense and income tax (and plus/minus non-operating revenues, expenses, gains, and losses, if there are any). If there are no 'below-the-line' items, then this is the same as the Net Income.

Below-the-line Items

Some forms of income, such as the sale of a building you are no longer going to be using, are included 'below-the-line' (i.e. below the reported Net Income from Continuing Operations) because they may not be expected to occur in the future. These include the effect of accounting changes, income from discontinued operations, and extraordinary items (gaines or losses that are unusual or highly abnormal).

Income Statement References:

- Financial Accounting: Reporting and Analysis by M.A. Diamond, E. K. Slice, and J.D. Slice., 2000.

- Income Statement, Net Income or 'Bottom Line' at wikipedia.org

Related Content

These are general accounting templates you can use for recording and reporting your company’s financial transaction daily. To use these templates, you may need basic accounting knowledge since there are particular accounting terms and methods for recording particular transactions. These templates are also suitable for people who use double-entry book keeping method on recording their daily transaction. What is the benefit of having double entry book keeping transaction? The main benefit is people can easily map all transactions into company financial report automatically. Financial report is a main parameter to evaluate particular company’s performance. Investors can easily see how profitable the company is by seeing its income statement. Investors also can see the value of its company from balance sheet report.

There are plenty of accounting software for this accounting purpose, but only a few that people can find in Microsoft Excel. These accounting templates below are free individual accounting templates where there is a paid version that integrate all individual templates to form financial report automatically. Here are all of them:

Accounting Journals Templates

In accounting, journal is interpreted as any financial transactions that are recorded in chronological order within one accounting period. You can find several type of journals, like general journal and special journals, where they are used in different business categories. For example, business that only give services to their customers usually need general journal only, while business that sell products need special journals to complement general journal. All accounting journal templates below have similar format. You can also duplicate them for other type of journals.

Because these individual journals are part of integrated accounting template, you may use the Chart of Accounts worksheet to classify each financial transactions. You will see this Chart of Accounts useful when you create a report where you need to pull respective data into respective month in its financial report.

All journals have debit and credit columns that needs to be balanced. Remember, these templates accommodate double entry book keeping method, so you must classify one transaction into at least one debit and one credit account.

General Journal Template

General journal is a journal where you can type all of the transactions, cash and non-cash transaction. In service type companies, you will need this journal only. For company who sell products, like distributors or retailers, you use this general journal for non sales and purchase transactions. Sales and purchase transactions will be recorded in special journals.

General Journal Template (169.5 KiB, 894 hits)

Special Journals Templates

There are three special journal templates you can download. Sales and Purchase journals where you can record any non-cash transaction for respective sales and purchase categories, and Cash Journal to record cash transaction for all Sales and Purchase Category.

Special Journal Template (177.8 KiB, 733 hits)

Some inputs might needs to separated manually, like bank loan payment where you need to separate its principal and interest. You can use loan amortization calculator to help you separate it correctly.

Adjusting Journal Template

You may need this journal to type any transaction that can’t be put into general and special journals. For example, inventory value calculation. This amount needs to be written for financial report purposes, like in balance sheet and income statement.

Income Statement Template Microsoft Word

Adjusting Journal Template (168.2 KiB, 710 hits)

General Ledger Template

In integrated accounting template, you don’t have to do anything with this template. The excel formula has done its work by grouping similar categories or Chart of Accounts from different journals into one table.

In this individual template, you must write all transactions of similar Chart of Accounts into one worksheet. You can duplicate the worksheet for other accounts to continue recording the transactions. Basically, it is a redundant task if you have to fill both accounting journals and general ledger table.

Remember to set balance method in each worksheets. You can set it either debit – credit or credit – debit. It depends on the account characteristic.

General Ledger Template (180.6 KiB, 747 hits)

Income Statement Template Microsoft Word Template

Balance Sheet Template

Balance Sheet statement is one of important financial report that will show any investors or company’s owners their company’s value within one accounting period. In general balance sheet format, they will see their assets value at the left side and their liabilities and capital values at the right side.

Income Statement Template Microsoft Word 2019

There are five worksheets in this template. The first worksheet is a Chart of Accounts worksheet where you can classify your financial transaction data. The second worksheet is a balance sheet format worksheet where you can select any accounts and type respective values to be shown in balance sheet report. Remaining worksheets are report worksheets. You will get two automatic report worksheets and one manual report worksheet. In manual report worksheet, you can create your own report with your own format.

Balance Sheet Report Template (193.7 KiB, 788 hits)

Income Statement Template

Similar with balance sheet statement spreadsheet, you will get five worksheets. Define Chart of Accounts classification in the first worksheet and format your profit and loss report in PnL format worksheet. There are two models of income statement visualization that you will see in PnL Report-1 and Report-2 worksheets automatically. PnL Report-3 worksheet will allow you to create your own profit and loss report from the scratch. To remind you, income statement or profit and loss statement aims to show you how profitable is your business within one accounting period. Any negative values should warn you to prepare new strategy to keep your company in right profit direction.

There are dummy data for trading/retail company type of business where there are cost of sales/cost of goods sold used as income subtraction for calculating gross profit/loss values.

Witness Statement Template Microsoft Word

Profit and Loss Statement Template (192.5 KiB, 723 hits)

Cash Flow Statement Templates

Investors or company’s owners see this cash flow statement to evaluate company’s health in terms of cash flow. There are three elements to present required financial transaction. Those are :

- Operating activities. Values are usually taken from income and expenses in balance sheet report.

- Investing activities. It is related with assets in balance sheet report.

- Financing activities. Values are taken from owner’s capital and liabilities in balance sheet report.

And, there are two general methods to present this report. Direct Method and Indirect Method.

Direct Method Cash Flow Statement Template

This one is a simple method where it basically reports cash income and expenses in gross. This template is already filled with dummy accounts and financial data that should help you understand this method. You can replace them with your own financial data.

Cash Flow Report Template - Direct Method (179.0 KiB, 681 hits)

Indirect Method Cash Flow Statement Template

This method takes into account non cash transaction and any adjustment with net profit. Dummy data in this template should help you understand this indirect method. Once you understand it, you can replace it with your own data.

Cash Flow Report Template - Indirect Method (179.4 KiB, 764 hits)

Equity Report Template

This report will show you status of owner’s capital within one accounting period. If you are the owner of the company, you will see your shares values in this report.

Equity Report Template (172.3 KiB, 721 hits)

Above templates are part of integrated accounting templates that you can purchase if you want to have your financial transaction processed automatically in financial reports. Also, there is a free version of the complete worksheet that you can download as well. You can read more detail in PRO worksheet in each downloaded templates.